The Reserve Bank of Australia and global accounting giant KPMG are coordinating a program to turn Australia into a financial surveillance state. The Morrison government’s cashless welfare card, and draft $10,000 cash ban bill, are part of the program to force Australians into a cashless economy system that will enable the private banking cartel and government to “monitor and measure”—their words—the financial activities of every Australian.

In breaking news, however, the Citizens Electoral Council’s fight against the totalitarian cash ban is hitting home! The bankers’ toilet paper, the Australian Financial Review, which for years has papered over their financial crimes and campaigned against any effort to hold them to account, including the royal commission, is rolling out a series of lying hit-pieces on the CEC and others leading the resistance, including banking expert Martin North and independent economist John Adams. AFR’s Aaron Patrick attacked North’s credibility in a pathetic 6 September smear; now, the same reporter is specifically targeting the campaign against the cash ban and the CEC, hysterical at the massive public support for the campaign and the break-out media coverage it has generated.

AFR is defending the criminal banking apparatus and its totalitarian agenda:

In 2012 the RBA—the high priests of the financial system who conjured Australia into a debt and real-estate bubble, and now use monetary policy solely to pump more debt into the bubble to prop up the banks—conducted a review of the payments system, using its legislated powers, unique among central banks, to promote “efficiency and competition” in the payments system. That review led to the establishment of the Australian Payments Council (APC), which was founded by the Australian Payments Clearing Association (APCA, now Australian Payments Network) to “promote a strategic agenda for the Australian payments system through industry collaboration”. The APC set out to create the platform for “real time” electronic payments clearing (including peer-to-peer consumers instantly paying each other through their phones), which is the infrastructure for a cashless economy. This idea became the New Payments Platform (NPP), and to coordinate the project and “industry efforts to bring it to life”, APCA engaged global accounting giant KPMG.

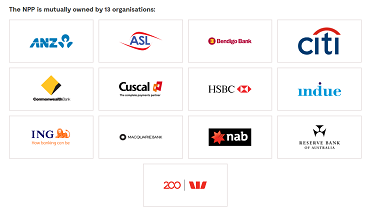

The NPP is now up and running, although in a fledgling state. It is jointly owned by 13 of the biggest financial institutions in Australia. Extraordinarily, the RBA itself is one of the owners—a massive conflict of interests for Australia’s central bank to effectively be in a business partnership with the private institutions it is supposed to regulate. Another curious name on the owners’ register is Indue, the private corporation that holds the contract to manage the government’s cashless welfare debit card, for which Indue is paid $10,000 per card, and which the government wants to roll out Australia-wide.

While KPMG was coordinating the NPP, its former boss, Michael Andrew (now deceased)—the only Australian to ever become the worldwide boss of one of the Big Four global accounting firms—was chairing the government’s Black Economy Taskforce. In the Taskforce’s 2017 report, Andrew recommended the $10,000 cash ban to: “Move people and businesses out of cash and into the banking system, which makes economic activity more visible, auditable and efficient.” In other words, to force Australians on to the NPP!

Financial surveillance state

In a chilling podcast interview with CPA Australia that same year, Andrew emphasised the need to “shift from a cash to a non-cash society where we can therefore monitor and measure people’s activities”. (Emphasis added.) Bizarrely, he singled out paying cash to “your nanny, your personal trainer, your gardener, your window cleaner” and “tradies offering discounts for cash” as “part of the problem” of the black economy that must be stopped by “visible” enforcement that avoids long court processes. This can only be interpreted as some form of summary punishment in which the onus of proof is reversed, as his report formally recommended.

KPMG is the black economy!

This totalitarian system of surveillance and punishment Andrew proposed is premised on a ridiculous lie. The truth is, Australia doesn’t have a serious black economy problem!

A 2017 study by Leandro Medina and Friedrich Schneider, “Shadow Economies around the World: New Results for 158 Countries over 1991-2015”, ranked Australia’s black economy as 10th smallest out of 158 countries. Moreover, its rankings demonstrated that cash use is irrelevant to the black economy: Japan has the heaviest cash use in the world, but an even smaller black economy than Australia, while all of the European countries with the most severe cash restrictions, including Spain, France, Italy, Denmark and Sweden, have much bigger black economies than Australia.

Australians using cash aren’t the black economy—KPMG and its accomplices and banking clients are! KPMG is one of the Big Four global accounting firms, along with EY, PwC, and Deloitte, which between them audit 98 per cent of the world’s biggest banks and corporations. The Big Four are at the core of the global “black economy”, their audits central to the way corporations hide their financial crimes, including tax evasion and money laundering. The UK’s Tax Justice Network estimates that transfer pricing is used to evade over US$500 billion in taxes globally, while banks, corporations and the ultra-rich hold between $21-32 trillion in “offshore” jurisdictions. These are the Big Four’s clients. In the UK, the centre of the global offshore network, the Big Four actually write the tax laws they then use to help their clients avoid tax; in Australia, Treasurer Josh Frydenberg’s “High Level Advisory Panel” on tax is dominated by five executives from EY, three from Deloitte, five from KPMG and seven from PwC. Yet KPMG alone has been fined more than $500 million for tax and accounting fraud, and the Big Four are now the subject of an Australian parliamentary inquiry!

It’s not just tax evasion. KPMG was the auditor for British banking giants HSBC and Standard Chartered when they were caught money-laundering in 2012, involving massive accounting fraud that occurred on KPMG’s watch (under Australian Michael Andrew’s leadership).

The CEC calls on all Australians to fight this criminal banking apparatus and their strategic agenda to turn Australia into a financial surveillance state.

Click here to sign the Change.org petition: Stop Scott Morrison from banning cash to trap Australians in banks!

Click here for a free copy of the latest issue of the Australian Alert Service.