The scandal over the integrity of real estate data company CoreLogic’s figures for house prices is ominous—for the banks. If the company’s figures aren’t true, as independent experts suspect, then the banks are in immediate financial danger, and Australians are in danger of having their savings deposits bailed in to prop them up.

As house prices plunged in the dominant Sydney and Melbourne markets from mid-2017 onwards, Australia’s big four banks faced collapse. With at least 65 per cent of the business of each of the big four tied up in mortgages— a far greater exposure than any other banks in the world— the falling prices were annihilating the value of the collateral behind their razor-thin capital.

Thanks to the ruse of “risk-weighting”, the banks’ capital, claimed to be 10-14 per cent, which the regulator touted as “unquestionably strong”, was actually 5-6 per cent. House prices would only need to fall 10 per cent to wipe out all the capital and smash the banks.

By election day on 18 May 2019, Sydney’s prices were down over 14 per cent and Melbourne’s over 10 per cent; all capital cities except Hobart had fallen, but Sydney and Melbourne were the main game. The government had hit the panic button, announcing a week before the election a new scheme to enable first home buyers to buy a house with just a 5 per cent deposit. The opposition Labor Party immediately supported the policy.

Banking fraud expert Philip Soos of LF Economics explained to the 31 May CEC Report that if price falls reached 20 per cent, the banks would have to revalue their mortgage assets and put aside more capital against their mortgages—a lot more—which they wouldn’t have. The Philip Soos interview was titled: “Only fraud can turn around falling house prices”.

Fast-forward six months, and all of the media reporting is of a stunning rebound in house prices. On 2 December, Alan Kohler reported on ABC News that Sydney was up 8.2 per cent from its May low, and Melbourne up 8.3 per cent. According to CoreLogic, prices shot up 3 per cent in just the month of November, the fastest growth in 31 years, translating into annualised price growth of more than 26 per cent!

Fraud?

According to CoreLogic, house prices started to rebound in August. As the company repeated this claim during August and September, however, it didn’t make sense. The figures were contradicted by excruciatingly low property sales volumes, which was causing carnage in the real estate industry, with companies being forced to retrench staff en masse. Construction job losses were also soaring. Most telling was the RBA’s data for housing credit growth, which every month continued to fall to new record lows, and still is: October recorded the lowest annualised increase ever of just 3 per cent. In mid-September, both Prime Minister Scott Morrison and Treasurer Josh Frydenberg, who would have access to better information than most, betrayed the level of official panic when they effectively begged the banks to increase their lending into housing.

On 1 October REA chief economist Nerida Conisbee made the stunning admission, in an interview with banking and real estate expert Martin North on his Digital Finance Analytics (DFA) YouTube channel, that her company, which owns realestate.com.au, had not seen the price rises in Sydney and Melbourne that CoreLogic was claiming. While qualifying that prices have risen in premium suburbs, Conisbee revealed that in terms of overall prices, “We’re not seeing growth in Melbourne and Sydney as yet … we are still seeing price declines.” (Emphasis added.)

Conisbee’s observation sent shockwaves through the real estate industry, but the mainstream media has continued to push CoreLogic’s figures, mainly because the major media companies in Australia are now in commercial relationships with large real estate companies. For instance, the Nine group, which owns the Nine television network and the former Fairfax stable of newspapers, also owns giant real estate publisher Domain. It’s in Nine’s interest to talk up the market.

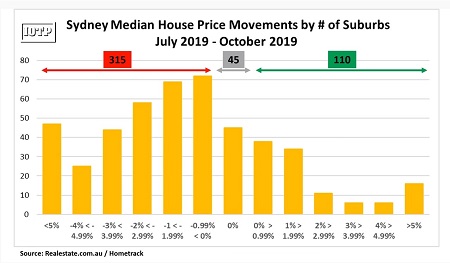

On 17 November, Martin North and independent economist John Adams questioned the CoreLogic figures on an episode of their Interest Of The People (IOTP) YouTube channel, “The Fishy Assassination Of Australia’s Property Price Debate”. Adams presented analysis by Lindsay David of LF Economics, which showed that in the period of July to October in which CoreLogic claimed prices rebounded, the median house price fell in 315 suburbs in Sydney, stayed flat in 45 suburbs, and rose in only 110 suburbs. They also reported the allegation of Sydney real estate expert Edwin Almeida that Nerida Conisbee had been silenced. “It’s alleged that Nerida Conisbee from REA has been shut down for defending the truth re Property Data and how the [CoreLogic] Hedonic Daily Index is misleading at best”, Almeida tweeted on 17 November. “I have heard this from 3 sources and it wouldn’t surprise me if Nerida’s job is on the line.”

CoreLogic claims its Daily Hedonic Index is able to read the tea leaves and detect minute daily price changes across the housing market. The day after their 17 November show, Adams and North recorded a new show to report that CoreLogic was claiming that in the one day since their previous show Sydney prices had already risen by 0.23 per cent! “How did the market move so rapidly in the last 24 hours?” questioned Adams.

A more detailed analysis of CoreLogic’s figures was even more revealing. According to its index, CoreLogic claimed that Sydney house prices had stopped falling on 19 May—the day after the federal election, and that Melbourne’s stopped falling a few weeks later. This itself is extraordinary, as it means the index perfectly fits the political narrative at the time that it was the Labor Party’s proposed negative gearing reform that was undermining the market, not the fact that the market was a bubble deflating under its own weight.

Even more extraordinary is that after bottoming out for a few months, CoreLogic’s index claims that prices in both Sydney and Melbourne started rising on exactly the same day—13 August. The only related event on that day was the now infamous “wagyu and shiraz” court decision in favour of Westpac against ASIC’s charges it breached its responsible lending obligations. (In finding in favour of Westpac, the judge stated that if borrowers were in mortgage stress, it wasn’t Westpac’s fault for knowingly lending more than they could afford to repay, it was their own fault for living too opulently, and they should stop eating high-grade wagyu beef or drinking expensive shiraz wine.) However, even though this ruling benefited the banks and their mortgage lending, and helped to hide the fraud exposed by Philip Soos, it doesn’t explain prices starting to rise in both major markets that very day. Besides, both the RBA’s figures for housing credit growth, and the Morrison-Frydenberg intervention a month later begging the banks to start lending, prove that the Westpac ruling didn’t lead to increased lending that could be credited with pushing up prices.

The suspicion must be, and is, that CoreLogic is producing an index to fit a narrative, and hype market behaviour that isn’t happening in the hope that it leads increasing numbers of people to rush back into the market. In other words, CoreLogic is trying to orchestrate a self-fulfilling prophecy. When Philip Soos in May predicted that only fraud could revive the market, he was referring to mortgage lending fraud of the type that had driven the market up for years; as it happens, it would seem he was right anyway, but it was a different type of fraud. If CoreLogic’s apparent strategy works, and enough buyers do rush in and prices rise, nobody will detect the fraud. If it doesn’t work though, and the market doesn’t boom, then many people, especially young people lured by the new first home buyers’ 5 per cent deposit scheme, will be trapped in unpayable debt and negative equity. More alarming, the banks will still be staring into the abyss.

Joye to the banks

CoreLogic is a $3.3 billion firm based in Irvine, California, with major arms in the UK, Australia, and NZ, among other places. It heavily overlaps the biggest vested interest in a rising market, the banks. Many of its top personnel including its chief executive are drawn from banks, and there are executives at CoreLogic dedicated to building relationships with the major Australian banks and meeting their needs.

Closely connected to the company is economist Christopher Joye, a former Goldman Sachs and RBA economist and now fixed-income manager with Coolabah Investments, which has heavy exposure to the mortgage market. Joye is also a contributing editor to the Australian Financial Review, which is the main cheerleader for the banks and real estate industry in Australia.

In March 2019, when prices were still falling, Joye famously debated John Adams on the Peter Switzer-hosted show Your Money, against Adams’ thesis that Australia’s record household and foreign debt was leading towards economic Armageddon. Joye attacked Adams as “relentlessly wrong” because interest rates were falling and therefore the higher debt burden would still be serviceable; he boasted of his track record in always forecasting the market correctly. Less than modestly, Joye declared himself the winner of the debate in a “TKO”, but the YouTube recording of the debate went viral, and most comments awarded the victory to Adams.

One of Joye’s claims to fame is his deep involvement in the real estate sector, going back to when he was at the Menzies Research Centre and authored an influential report for the 2003 Prime Minister’s Home Ownership Task Force. In 2008 Joye is credited with advising then-Treasurer Wayne Swan to intervene in the shaky mortgage securitisation market by investing directly in mortgage-backed securities to prop the market up. Most tellingly, Joye also helped to develop CoreLogic’s vaunted Daily Hedonic Index.

Joye is clearly a bigwig in Australia’s financial establishment, but, unusually, he’s also incredibly well connected into the military and security side of the establishment. At the AFR, Joye seems to have been the go-to guy for the highest-ranking officials in the Anglo-American “deep state” pantheon to give interviews that break strategic news. He’s had exclusive interviews with the directors of the Australian Security Intelligence Organisation (ASIO), David Irvine, and the Australian Signals Directorate (ASD), Ian McKenzie; the most comprehensive interview ever with the former head of the US Central Intelligence Agency (CIA) and National Security Agency (NSA), General Michael Hayden; and an exclusive interview with the longest-serving director of the NSA, General Keith Alexander.

These connections serve to illustrate Joye’s, and CoreLogic’s, involvement with the highest levels of the banking and security establishment, the power of which would be under extreme threat if there were a banking crisis caused by a housing collapse. Not only would the banks implode, threatening a global chain-reaction meltdown through potential defaults on their international derivatives obligations, but the ensuing financial crisis would threaten the political power structures, as angry citizens rose up in protest. That’s a powerful motivation to talk up, and more, the housing market, to save the banks. If these well-founded suspicions are true, however, and the talk is hype, then the inverse is true, and the banks are in more trouble than ever.

On 2 December, Bob Katter MP introduced a bill into Parliament for a government audit of the banks, including their mortgage books, to find out exactly how much trouble they are in.

Australian Alert Service, 4 December 2019