The Australian government and numerous members of parliament claim it is nonsense to suggest the proposed ban on cash transactions over $10,000 is designed to keep depositors trapped in banks. With a new global financial crisis under way, negative interest rates and “bail-ins” are the order of the day and people are looking for ways to escape them. Along with quantitative easing and other bailout mechanisms, they are both ways of robbing bank customers to keep Too-Big-To-Fail (TBTF) banks afloat during a crisis.

Negative interest rates are currently hitting European banks hard, especially smaller ones, leading to “increasing concentration and control” of the system in a small handful of big banks, in the words of Professor Richard Werner, a German banking expert at Oxford University. Cited in the London Telegraph on 22 August 2019, Werner warned that negative interest rates were “wiping out the remaining 1,400 savings and community banks” in Germany. “What the ECB [European Central Bank] is doing favours the big casino banks. It is going to ruin Germany in the end. It is criminal”, he concluded.

Bail-in, which confiscates customer money to keep banks solvent, has the same effect. In documents spelling out its “resolution” procedures, the Bank of England spells out that some banks can be allowed to collapse as their failure won’t affect the wider economy, but others are too big to be allowed to fail, and must be rescued with a bail-in. The Bank of England worked hand in glove with the Bank for International Settlements (BIS) to create the bail-in regime—BoE Governor Mark Carney heading both relevant bodies.

An October 2015 article by Prof. Werner exposed that the real agenda behind banning cash is ensuring the viability of bail-in and negative interest rate policy. This reflected the intense fight in Germany at the time over proposed limitations on cash, which met with ferocious opposition from the population and most political parties, including the governing party. “It would also further the project to increase control over and monitoring of the population”, Werner added.

A quick look at the European experience dispels the Australian government’s claims that these policies are not motivating its bill, and gives a foretaste of what is to come.

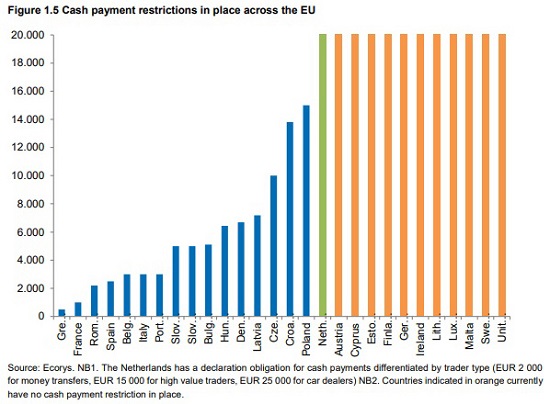

Negative interest rates on regular savings accounts are spreading across the continent, which means savers must pay to keep their money in a bank. At first the banks only charged commercial accounts and retail accounts in excess of one million euro, but now many banks being squeezed by central bank charges on their cash holdings are passing on the costs to customers. Furthermore, in 17 Eurozone nations negative interest rates were preceded or accompanied by restrictions on cash, limiting options for consumers. (Chart)

Rates have been negative since mid-2014 and the IMF recently indicated they are here to stay. When the ECB cut its deposit rate from -0.4 per cent to -0.5 per cent in September 2019, more banks began to go negative. “The floodgates are open”, Friedrich Heinemann from the ZEW economic research institute in Mannheim told Bloomberg. “We will soon see a chain reaction.”

A tiering system so banks are not charged the negative rate on all deposits held at the ECB is “a drop in the ocean”, according to Morgan Stanley analyst Magdalena Stoklosa, and will not save the banks much money. A senior Swiss banker said “very tough decisions” have to be made in this policy environment, the 18 September Financial Times reported.

European banks spent €7.2 billion on interest for their deposits in 2018; tiering lowers it to around €5 billion. German banks spent nearly 10 per cent of their annual pre-tax profit. When Moody’s downgraded its outlook for global banks in December 2019 it cited low interest rates as a major factor.

Negative interest rates, by country

Denmark: Interest rates paid on most savings accounts have fallen to at least zero. Danmarks Nationalbank first introduced negative rates in mid-2012. Jyske bank, the country’s third largest, moved to a negative rate on business accounts in 2016, but on 1 December 2019, like several other Danish banks it introduced a -0.6 per cent rate on deposit accounts over €1 million.

Søren Mortensen, CEO of the smaller Alm Brand bank, has called for larger banks to pass on negative rates to smaller retail accounts, in order to take the pressure off smaller banks which are reluctant to take the first step, according to Bloomberg. “[N]o bank here wants to be the first mover into negative deposit rates”, Jyske economist Mikkel Høegh had said in August 2019. “[W]e can’t rule out the risk” that ordinary depositors might be affected, observed Chief Financial Officer Birger Krogh Nielsen. “The negative interest-rate environment could turn even more negative. We monitor the situation continuously.”

Netherlands: The largest three banks will pay near-zero or zero interest on savings accounts from April 2020. Many small savings accounts are as low as 0.01 per cent. From 1 April ABN Amro’s general rate will be 0.00 per cent, and -0.50 per cent for balances over €2.5 million. ING is the second Dutch bank, after ABN, to charge -0.5 per cent on larger accounts, over €1 million.

Belgium, Portugal: Local law prohibits negative interest rates on deposit accounts. (Some countries with legal restrictions charge extra account or deposit fees instead.)

France: The best rates are promotional rates for fixed terms, but are still generally lower than one per cent. Crédit Agricole has increased retail fees to offset low rates. Large banks offset losses with an increase in speculative investment, corporate banking business or international diversification—all moves away from retail banking. Société Générale’s chief executive Frédéric Oudéa told FT on 6 October 2019: “There is not a single bank which wanted to be arbitraged by other banks. Imagine that the other banks charge and you are the only one not to charge. You will see a flow of deposits coming to your balance sheet. You don’t know what to do with that. You put that in the central bank. You pay.”

Italy: After the last ECB rate cut, Unicredit announced it would charge customers with accounts over €100,000. To improve profits, it appears some Italian banks with lower ECB deposits are exploiting the difference between zero per cent rate ECB deposits offered under the tiering system, and loans taken out at negative rates.

Switzerland: UBS and Credit Suisse impose negative interest rates on their wealthiest clients. From November 2019 UBS introduced a charge of -0.6 per cent per year on deposits of over €500,000, where previously it was €1 million. The rate for larger accounts is -0.75. (The Swiss National Bank charges -0.75 per cent to Swiss banks, much higher than the ECB rate.)

Germany: German banks have been hit hardest by negative central bank rates, as, according to FT, “they hold around a third of total excess ECB deposits”. Germans are the biggest savers among Europeans, saving double that of other nations, keeping 27 per cent of their wealth in some type of deposit account. Negative rates cost German savers €27 billion in 2019.

A survey by the German central bank conducted after the ECB’s September 2019 rate cut revealed that nearly 60 per cent of banks charge negative interest rates on corporate deposits and over 20 per cent charge them on retail deposits.

Deutsche Bank is passing on negative rates to around a fifth of its retail accounts. At this stage it has approached large depositors individually, given difficulties changing terms and conditions across the board. Likewise, Commerzbank is approaching customers with accounts over €1 million.

Volksbank Raiffeisenbank Fürstenfeldbruck was the first German bank to pass negative rates on to small savers. It began charging a rate of -0.5 per cent on new accounts of any amount from 1 October 2019, previously only on accounts over €100,000. Since December 2019 both VR Bank Westmünsterland and Kreissparkasse Stendal began charging new customers depositing over €1 up to -0.5 per cent.

The biggest cooperative lender, Berliner Volksbank, has a -0.5 per cent rate on accounts over €100,000. The next largest cooperative, Frankfurter Volksbank, in December was considering rates of -0.55 per cent on all deposit accounts. It has not yet made the move, but fears a large inflow of deposits on which it would have to pay interest, if it does not.

After the September ECB rate cut, according to bitcoin. com, Deutsche Skatbank announced: “We can no longer economically accept responsibility for maintaining the ECB negative interest rate in full. So far, negative interest rates were only incurred for large-scale depositors. As a result of its actions, the ECB leaves us no other choice than to further restrict our deposit business.”

Also reported by bitcoin.com, German consumer price comparison platform Verivox has published a list of 41 banks with negative rates on deposit accounts and seven charging fees for money market accounts (normally free). Another price comparison website, Biallo, claims that more than 150 German financial institutions are charging negative rates, albeit they are not named.

Cash restrictions

There are cash restrictions in 17 EU nations, with limits ranging from €500 to €15,000. In 2016 European Union-wide limits were proposed. The European Commission completed a report on the proposal in June 2018. The EC claims it “is not considering any legislative initiative” at this time.

Unlike the research conducted by the Australian Treasury (outsourced to KPMG), the EC-commissioned a study which included an “Impact assessment” on various aspects of the economy, business, privacy, etc. under different proposed scenarios. A survey of the public revealed 95 per cent of people rejected the imposition of restrictions on cash payments. While the matter was raised in connection with targeting money laundering, criminal activity, terrorist financing and tax evasion, the EC-commissioned study found that cash restrictions would have little impact on terrorist financing and tax fraud, and that while it might be useful in combatting money laundering, the impact could not be quantified. The report noted that a cash-limiting scheme “does not capture larger tax evasion schemes, which do not depend on cash at all”.

In blog posts in August 2018 and February 2019 the IMF provided an initial blueprint of how to make negative interest rates work given the impetus of people to move into hoarding cash, blunting the intention to make people spend. These papers, including “Cashing in: How to make negative interest rates work”, were reviewed by economist John Adams in a February 2019 paper, “The new global push for negative nominal interest rates”, available at adamseconomics.com.

A subsequent IMF paper, “Enabling Deep Negative Rates to Fight Recessions: A Guide”, published in April 2019, continued the discussion of eliminating the “zero lower bound” on interest rates, i.e. cash, so central banks can sustain deep negative interest rates, providing them “unlimited monetary policy firepower”. This boundary presents “a serious obstacle for monetary policy”, stated the paper; that is, for the ongoing big-bank bailout.

It examines whether this “requires quantity restrictions on cash (or instead relies on the price system to alter the rate of return for paper currency)”. The alternative to restricting cash is creating a “negative paper currency interest rate”—effectively taxing the use of cash in the same way money is taxed in a negative rate account, eliminating the cash advantage. The IMF’s “clean approach” would involve approximating an exchange rate between paper and electronic currency. This is the preferred approach, as it would avoid “drastic changes in the way people transact [and therefore] one possible source of political opposition.” The other is a “rental fee approach”, imposing a transaction fee equivalent to a negative interest rate, for obtaining cash. Central banks would charge a rental fee for paper currency issued, which banks would pass on to the consumer.

By Elisa Barwick, Australian Alert Service 5 February 2020